The Best Investment Watch Brands & Models You Can Buy In 2024

We attempt predict which brands and watches will continue to appreciate in value

First, a caveat: you shouldn’t really buy a watch with one eye on its ROI. You buy a timepiece you love – one that you hope to pass down to the next generation – but also on a practical level, unless you’re lucky enough to get your hands on a steel Rolex Submariner or a Nautilus, buying to flip is often a game of chance.

Auction prices, the vagaries of fashion, market demand, the changing tastes of people… all these things and more will affect how much return your horological investment will actually yield. Which is why, when watch journalists are asked what to invest in, usually by eager people whose heads have been turned by the latest news of a $17.7m Paul Newman Daytona, we decline to answer.

However, the question persists, so here’s a by-no-means exhaustive guide to the luxury watch brands and timepieces that are likely to not lose you money. As for how much you could make from them, we’ll leave those answers to people with crystal balls. If it didn’t need saying already: this is not financial advice.

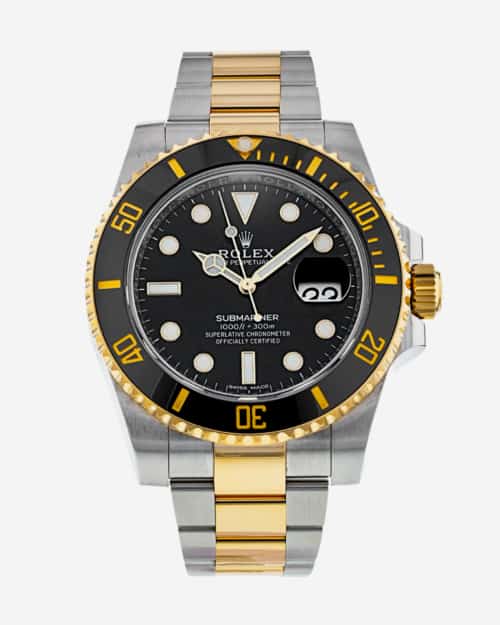

Rolex

Technically, anything bearing the five-pointed crown is going to be a solid investment. However, if you want to drill down to specific collections that will always do well then you want a Submariner, a Daytona, an Explorer II, a GMT-Master II or a Sea Dweller. And you’ll want to find one in steel.

Waiting lists that are harder than the Space X passenger list to get on to, which means that the only place you’ll find these is on pre-owned sites – and you’ll be paying a premium.

Meteorite dials are also worth keeping an eye out for. They are expensive, but as Rolex only makes them every so often, they have extra cultural cache.

Omega

You have two choices here: Speed or Sea. Master that is. Because Omega doesn’t have the supply issues associated with the likes of Rolex, it’s never going to command the big bucks at auction but it’s still a solid investment.

For the Speedmaster, the model to opt for is the Professional Moonwatch, for all the obvious reasons: its ancestor was the first watch on the Moon, worn by the crew of Apollo 11. It might be tempting to choose a limited edition, but just because it’s limited doesn’t always mean it will be popular with collectors. That said, meteorite dials are always worth seeking out.

If you’re looking to go vintage with the Speedmaster, try and find the ref.145.012. It was worn by more astronauts than any other Speedie and contains the coveted calibre 321 (which purists believe is the only calibre a Speedmaster should have). Because it never actually landed on the Moon it isn’t as expensive as the 145.012 or 105.012, which did.

Seamaster rules are simple: keep it steel. Some corners of the pre-owned market are also betting on the Spectre limited edition as a potential future flipper, which means that surely the No Time to Die edition, commemorating Daniel Craig’s last outing as 007, could also have investment potential.

Patek Philippe

Given that Thierry Stern, Patek Philippe’s president, has announced that the Nautilus ref. 5711/1A has been discontinued, despite a rumoured 10-year waiting list, that’s the one to put your money on. You’ll have to re-mortgage your house, sell a kidney, and maybe the kids as well, but you’ll certainly get a decent ROI.

Nautilus aside, if you are keen to place your hard-earned cash in Patek’s hands, you can’t go wrong with a Calatrava. Simple and elegant, it’s a classic gentleman’s watch that will never go out of style. Its price is also rather eye-watering, but you can find some fabulous vintage models for much less.

The same is true of the Ellipse, Patek Philippe’s 1968 design whose measurements conform to the Golden Ratio: the ancient mathematical formula that supposedly describes a ratio that is the pinnacle of aesthetic perfection. They might not command the same prices as a steel Aquanaut or Nautilus but if you’re dying to get on the Patek ladder, this is where you start.

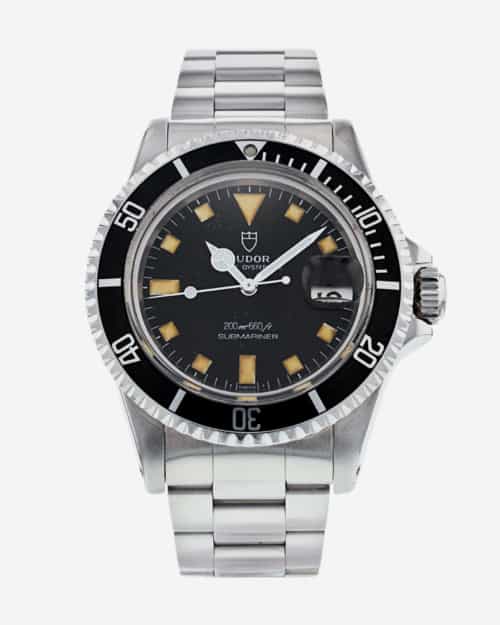

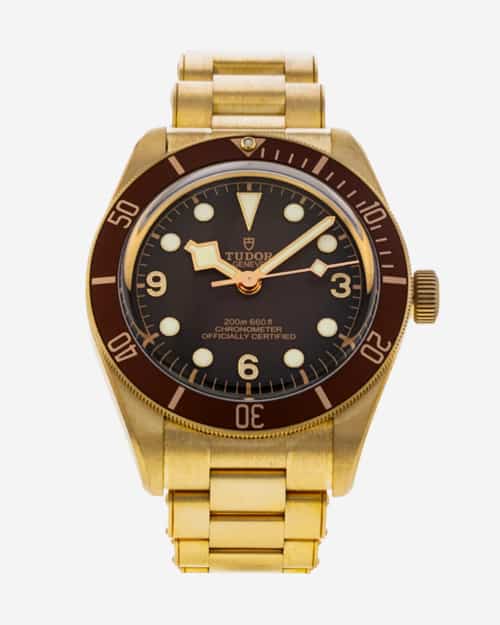

Tudor

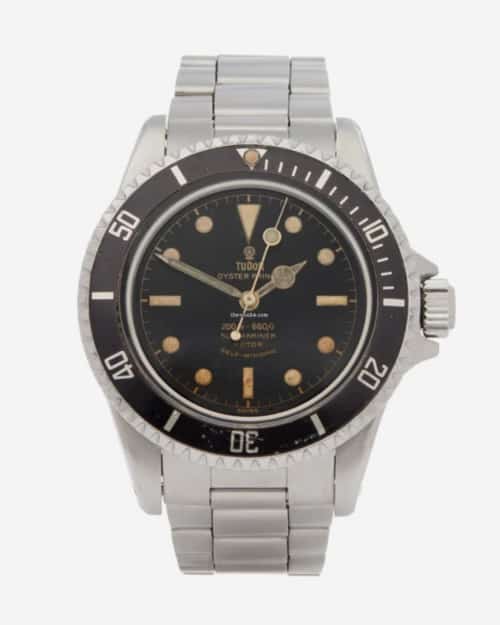

Bit of a curve ball seeing as acquiring a Tudor watch doesn’t require selling a vital organ or getting yourself on a waiting list, but it does have a cult following – something which has been helped by the fact that it was AWOL from the UK for most of the 2000s.

If you can get your hands on one, the vintage Tudor Submariner is a good investment, not least because the brand hasn’t resurrected it yet (though yearly rumours persist), while the also-unresurrected Tudor Prince Tiger Chronograph is another archive piece worth buying.

From the current collection, it’s the Black Bay Bronze – with the now pre-owned-only, full-bronze bracelet version being the smart choice.

Audemars Piguet

There is only one answer to the Audemars Piguet investment question, and that is ‘the Royal Oak’. Like the Submariner and the Nautilus, it is one of watchmaking’s most recognisable silhouettes.

Its origin story – Genta, Italian market, sketch needed by the morning, first luxury steel watch – is the stuff of horological legend and Audemars Piguet’s decision to only retail through monobrand boutiques has added to its investment potential.

Which Royal Oak? If you have the cash, go for the Audemars Piguet Royal Oak ref. 15202 in steel because it was discontinued in 2021, but really any Royal Oak in steel is a safe bet. You’ll have to buy pre-owned because, like the other steel notables, supply is significantly less than demand.

Vacheron Constantin

Not as well-known as the other brands on this list, but it’s a canny choice from an investment perspective. Vacheron Constantin is a respected Maison with over 260 years’ experience; everything bar the bracelets and cases are made in house, even the hairsprings, and, thanks to the introduction of the Fifty-Six collection, with its Val Fleurier-sourced movement, you can now buy a steel Vacheron for just over £10,000/$12,000.

If you can rustle up the cash, then 2022’s all-gold 222 looks like a model set to deliver on the ROI stakes – it’s not limited edition but will only be available from the brand’s boutiques and in small numbers.

If you can’t find enough spare change down the back of the sofa for the 222, then an Overseas in steel (naturally) is your go-to. The brand’s website has the price at £19,700/$22,500, but Watchfinder gives a truer price of £43,995/$55,435.

Cartier

This may seem like an odd addition to the list, considering Cartier is known for selling sub-5k steel quartz designs. However, the auction market has seen a rise in prices of rare Cartier watches from the 60s and 70s according to information provided to watch magazine WatchPro by luxury resale marketplace The RealReal.

This type of activity has had a knock-on effect on the prices of contemporary Cartiers. If you’re on a budget, opt for the classic Tank Solo with a mechanical movement, which won’t break the bank. If you have a more to spare, it’s the full-gold Santos.

Pre-owned, look for models that have been discontinued such as the Drive or the Roadster.